Category: stock trading

Buying 1 Million Shares of PINS (Pinterest Inc) on the NYSE at open tomorrow Apr 30

Shares of PINS will be added to the regular portfolio. I will buy 1 Million shares of PINS (Pinterest Inc) on the NYSE at open tomorrow Apr 30.

The Pinterest IPO came out 7 days ago.

PINS share prices have risen each and every day since. The trading volume increased today.

PINS-Pinterest Inc on the NYSE. Chart is courtesy of http://www.tradingview.com

Disclaimer: This post is not meant as Investment Advice, nor is it advice to buy or sell any shares in any company.. Do your own Due Diligence. Seek out the advice of your own financial and investment advisors before risking any funds in the Stock or Futures Markets. You can lose money and even all of it when investing at the Stock Market Casinos. This post is for my own educational purposes.

Posted by Vincent Banial

Low Priced Breakput stocks from last week. SCKT on Nasdaq (Socket Mobile, Inc.) and AKTX on Nasdaq (Akari Therapeutics, Plc).

Tried to buy 10,000 shares on Apr 26 of SCKT on Nasdaq (Socket Mobile, Inc.) at open tomorrow at fixed offer of $2.35 per share which was the close on Apr 25.

Why?

Triangle Breakout upwards. Their Gross Margin is over 50% for the Mobile Scanners they sell. Good luck making that kind of gross margin selling Computer Tech gear. I don’t think that Apple make over 50% gross margin. Small company turned a profit last quarter versus a loss previously. sat at the $2 barrier for a while. Now $2 is a nice support area. Target – potential Double…

Why?

They have had positive Phase 2 Medical Study Coversin Trial Results. Today the stock price Gapped Up on a high volume increase. The price came back down at the end of the regular trading day but still gapped up overall. Since the target is $6.00 I’ll set a sell stop at $5.75 to $5.90, just under the potential target.

Did not get filled. Not enough volume for 1 Million Share order. I still think it’s a nice breakout stock.

https://finance.yahoo.com/quote/AKTX/chart…

Disclaimer: I am not an registered Stock Analyst nor a licensed Stock Advisor. This post is not a suggestion for anyone to buy anything. Please seek the advice of your own licensed Investment Advisor before placing bets at the Stock Market Casinos. You can lose money – even all of it. This post is for my own educational purposes…

Posted by Vincent Banial

Bought 1 Million Midatech Pharma PLC American Depositary Shares (MTP) on Nasdaq on Apr 24 at $3.60 per share

Had posted thin on our Uniquely Toronto Facebook page. Moving it over this to this site.

This is the last of the buys for the Regular Portfolio from last week. Bought 1 Million shares of Midatech Pharma PLC American Depositary Shares (MTP) on Nasdaq on Apr 24 at $3.60 per share.

Why.

Major Price Breakout upwards with a huge spike in Volume. IMHO Volume Spike usual tend to indicate the Trend Direction will change. Expected price consolidation after price spike. Did not expect the price to drop this much. Holding, as this should bounce back up after hitting support

Midatech Pharma Plc (MTP) on Nasdaq. Chart courtesy of www.tradingview.com

When the price spiked up on Apr 24 it hit resistance and came back. Once the price starts back up and goes through that resistance (just under $4.00) the price should rise to the next resistance level around $5.00. Will likely try to sell around $4.90 per share. Yes, this trade is sitting at a loss, but IMHO the price is above the Support level and so I’m going to be patient and give this trade some time.

This stock is an example of the danger of trading Gaps. If I were to sell now, I would take a major hit. In contrast, look at the price of HELE since it Gapped. The price of HELE has risen daily since the Gap day. Hard to predict short term price action. I’m playing MTP for the longer term.

Disclaimer: I am not an registered Stock Analyst nor a licensed Stock Advisor. This post is not a suggestion for anyone to buy anything. Please seek the advice of your own licensed Investment Advisor before placing bets at the Stock Market Casinos. You can lose money – even all of it. This post is for my own educational purposes…

Posted by Vincent Banial

Next week I will try to buy 1,000 shares of HELE (Helen of Troy Limited) on Nasdaq at $135.50

Will try to buy 1,000 shares of HELE (Helen of Troy Limited) on Nasdaq at $135.50. It was trading a bit above $139.00 all Friday and closed a bit higher than that. I tried getting filled on Friday, but did not. I will try again next week. $135 is the Support level. Price should consolidate for a few days next week. If I get 1,000 shares at 135.50 per share, then will likely sell at $144.40.

From the latest Earnings Call Conference on April 26 : “This quarter caps great full year results. Net sales for the full fiscal year 2019 grew 5.8%. Leadership Brands grew 8.9%. Online sales grew approximately 28%, and adjusted diluted EPS grew 11.3%“

HELE (Helen of Troy Limited) on Nasdaq. Chart Courtesy of www.tradingview.com

Disclaimer: I am not an registered Stock Analyst nor a licensed Stock Advisor. This post is not a suggestion for anyone to buy anything. Please seek the advice of your own licensed Investment Advisor before placing bets at the Stock Market Casinos. You can lose money – even all of it. This post is for my own educational purposes…

Posted by Vincent Banial

Purchased 1 Million Shares of Twitter Inc (ticker TWTR on Nasdaq) this week.

I had posted this trade to our Uniquely Toronto Facebook page earlier this week. Am now brining that post to this site. Earlier this week I had purchased 1 Million shares of Twitter Inc on the NASDAQ exchange.

I am also going to split up the trading into two different portfolios. The reason for that is Low Priced shares of rather unknown companies can be a good vehicle for trading. My problem has been that you cannot get large quantity orders filled because their trading volume is too low. That situation could also come back and bite one, when they try to sell or quickly Dump a large number of shares. For example the 1 Million shares of Twitter was no problem to get filled. When I want to sell, it will also not be an issue. I’ll post the other stocks that I had posted about on our Facebook page.

So we’ll have the Regular Portfolio and we’ll have a New Trader Portfolio. The Twitter Trade is part of the Regular Portfolio. The low price shares will go into the New Trader Portfolio. This way I can pick up 1,000 shares without issue. One thing which I had picked up on and is my opinion that the more shares that you can buy, the higher your Potential capital Gains can be – and yes the Higher that your capital Losses can be. IMHO high priced stocks are not as volatile as their low cost cousins.

Ok back to Twitter. Twitter released their latest Quarterly result which beat street estimates. Fundamentals look great. The price had Gapped up – positive Technical sign especially when the price is in an extended Up Trend. So I bought One Million shares of TWTR on Nasdaq for an average cost of $39.30 per share.

Note the Low made on July 24 2018 at $41.59. That is my initial Target. There is greater resistance just above at $42.50 – another target would be just below that, say at $42.40. If the price fills that prior gap made on June 11 2018 then the next major resistance is at $45.00. The High Made on July 09 2018 at $46.90 is the next Target. IMHO in time the price of TWTR could break above that prior High. The next resistance would at $50.00, so I would sell at say $49.40. IMHO TWTR has nice potential for a nice Capital Gain over a bit of longer term. This was not bought for Day Trading or Swing Trading. This was bought to try and capture the Capital Gains under the “Investment” clause of the Tax act and so I would get 50% of the Capital Gain TAX FREE (in Canada).

After a Gap Up, a stock price will consolidate for a few days before continuing on it Up Trend. The price usually create a flag or pennant formation before moving up higher again. It’s just a matter to patiently wait…

Twitter Stock Chart courtesy of http://www.tradingview.com

The following is what I had posted on FB on Apr 23 at 10:02 pm:

“Buying a million shares of Twitter at open tomorrow Apr 24. TWTR on Nasdaq. Resistance is the bottom on the Gap formed on July 24 2018 ($41.59). That could be a target to get out. If it breaks up thru the resistance then next resistance is at $46.75 to $46.90. If it breaks upward past $47.79 then looking for $50.

Why am I buying? Strange for me, but because of Fundamentals. Twitter’s quarterly report surpassed Analyst Expectation. You also have the Twitter promoter in the White House who gets Twitter mentioned in the news almost on a daily basis. On top of Fundamentals the CCI looks great. So in my opinion I am buying because of Fundamentals and also because of Technicals.“

Disclaimer: I am not an registered Stock Analyst nor a licensed Stock Advisor. This post is not a suggestion for anyone to buy anything. Please seek the advice of your own licensed Investment Advisor before placing bets at the Stock Market Casinos. You can lose money – even all of it. This post is for my own educational purposes..

Posted by Vincent Banial

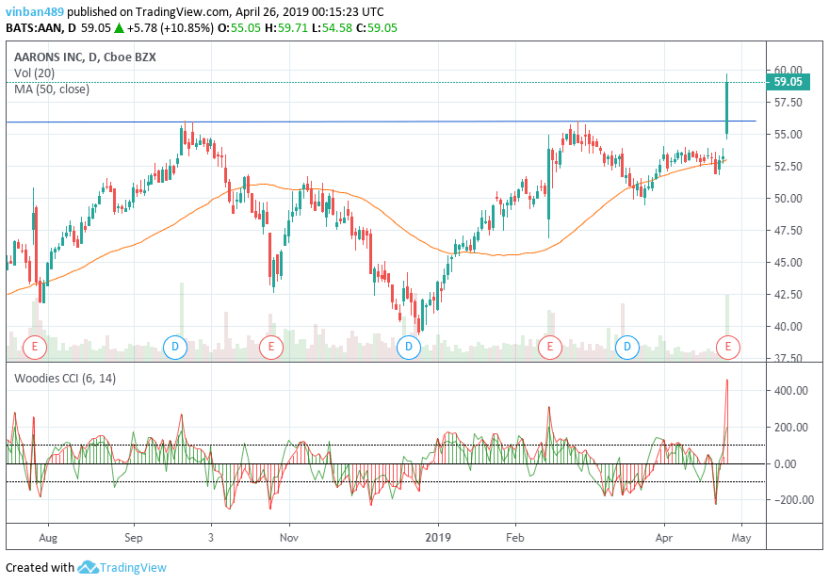

Bought 1,000 shares of AAN on the NYSE today

Have been posting some of my trading to the Uniquely Toronto Facebook page. Bringing this trade over to this our main site.

Purchased 1,000 shares of AAN (Aaron’s, Inc.) on the NYSE this morning. Picked up the 1,000 shares for $58.00 per share.

AAN shares trading on NYSE Courtesy of Tradingview.com

Reasons why I bought 1,000 AAN shares on the NYSE today::

Prior day Close was $53.27.

Today’s open was $55.05, Which means the Price Gapped UP (ie lots of buyers).

Much Higher Volume than normal at 1.5 Million shares.

Price moved above $56.04, which was the prior high set on Feb 27.

50 Day Moving Average is showing the price is in an extended Uptrend.

The Low of Feb 14 was not surpassed by the low on March 25.

So you had a Higher Low on March 25 which gives an indication

that the trend upward should continue.

Earning Per share rose over 30% in the reported Quarter.

So the Technicals looked great as did the Fundamentals.

I am not an registered Stock Analyst nor a licensed Stock Advisor. This post is not a suggestion for anyone to buy anything. Please seek the advice of your own licensed Investment Advisor before placing bets at the Stock Market Casinos. You can lose money – even all of it. This post is for my own educational purposes…

Posted by Vincent Banial